Selecting professional liability insurance for your firm can be a daunting and confusing process. Over the last 30 years underwriters of professional liability insurance have broadened the options available for you to consider. There are a number of limit and deductible options out there and all come with an added cost.

Whether you are purchasing insurance for the first time or have been in business for several years, understanding these options and how they impact your cost will help you make the right decision towards selecting the insurance policy that meets the needs of your firm.

Limits of Liability

Let’s take a look at the limits of liability section of your policy. You decide on purchasing $1,000,000 of coverage for your firm. This limit will be noted on your declarations page and will reference that the limit is for each claim and in the aggregate for all claims made against you and reported to the insurer during the policy period.

This option is considered a single limit which means that the total amount your insurance company will pay for damages and defense expenses during the policy period is $1,000,000. The available limit will be available for one or multiple claims reported during the policy period until the $1,000,000 is depleted.

Split Limits

Another option widely available is a split limit option. The split limit provides an added aggregate limit that is a multiple, typically 2 or 3 times the per claim limit you select. For instance, in addition to receiving a quote for a $1,000,000 limit you may also be offered a quote for a $1,000,000/$2,000,000 limit.

Under this option you still have a maximum limit for damages and defense expenses per claim of $1,000,000 similar to the single limit offering. In Addition, the split limit feature provides an additional $1,000,000 limit in the event that the first $1,000,000 is depleted by a claim or multiple claims.

Claims Expenses Outside the Limit

Another limit feature available is Claim Expenses Outside the Limit (CEOL). As discussed earlier, the standard limit of liability provision covers damages and defense expenses incurred. CEOL policies provide for the full limit to be available to pay damages with defense expenses paid in addition to the limit.

In some state’s regulations require companies to only offer professional liability coverage with CEOL and otherwise this feature is widely available. There is an added cost for this feature that will range between 5-20% charge depending on the limit of liability you have.

Deductible

There are also a number of different deductible options for you to consider that may impact your premium. The basic deductible option is a per claim deductible which applies to both defense expenses and damages for each claim made and reported during the policy period.

Insurance companies also offer aggregate deductibles which caps your out of pocket at the deductible amount regardless of the number of claims you report during the policy period. The additional premium you can expect to pay for this option will be around 5% of your base premium.

Another deductible option is first dollar defense which converts your deductible to apply only to damages. Under this option, the company will pay all defense expenses to respond to your claim and your deductible will only be due in the event that damages are incurred for the claim. This option will carry an additional cost of around 10% of your base premium.

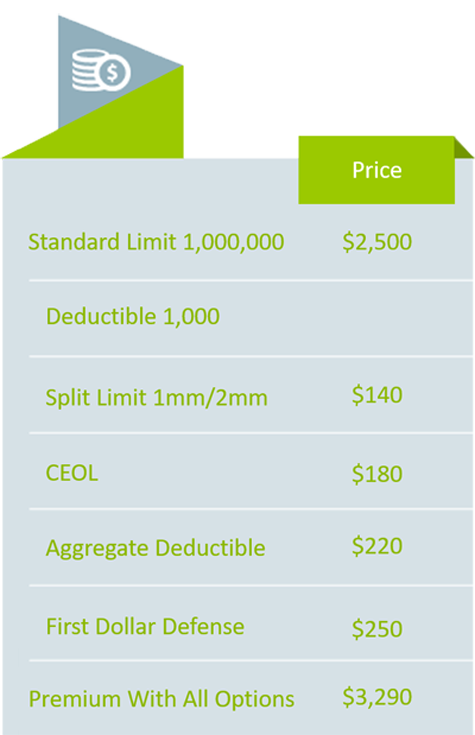

The following table summarizes estimated charges for the various limit and deductible options:

The limit and deductible options you choose can have a significant impact on the premium you pay for your professional liability insurance. Whether you are purchasing insurance for the first time or have had coverage in place for several years, take some time to review your coverage terms to ensure you understand the impact of the limit and deductible options on your premium.