When it comes to making big purchases, at some point in the process we’ve all had that thought, “Where can I go for some unbiased advice.”

In my role at Protexure Insurance Agency, I am dedicated to assisting attorneys in finding the ideal insurance carrier and policy that suits their individual needs. While I firmly believe in the merits of our Protexure Lawyers program for solo attorneys and small law firms, I understand that we may not always be the perfect match for everyone.

Furthermore, as a consumer myself, I know how frustrating it can be to feel like the account executive, sales associate, etc., is just trying to push the sale rather than listening to my needs and helping me find the best solution.

Sometimes, we just want a third-party source to help us evaluate our options, right?

I am frequently asked for a reputable source for attorneys to evaluate insurance carriers and know who is best.

Unfortunately, there is no clear-cut answer for who is the best. Like with most things, it comes down to personal preference and opinion.

But, when it comes to evaluating insurance carriers, attorneys don't need to rely on the potentially biased opinion of other attorneys, agents, or even insurance carriers themselves. There is an unbiased source for evaluating insurance carriers called AM Best Rating.

Unless you are in the insurance industry or have spent a significant time researching insurance carriers, you may be wondering, “What is the AM Best rating?” And furthermore, “Why should this rating be a contributor to my decision on which carrier I’ll choose?”

Throughout this article, I will be exploring why the AM Best rating is important to consider when choosing a legal malpractice insurance carrier. I’ll break down each rating and what they represent, while also making a recommendation on which rating fits your firm the best.

What is The Role of AM Best Company?

AM Best Company is a highly reputable organization that plays a crucial role in evaluating the financial strength and operating performance of insurance carriers. With a database of over 16,000 carriers, AM Best provides valuable ratings that help consumers gain insights into the stability and history of these companies.

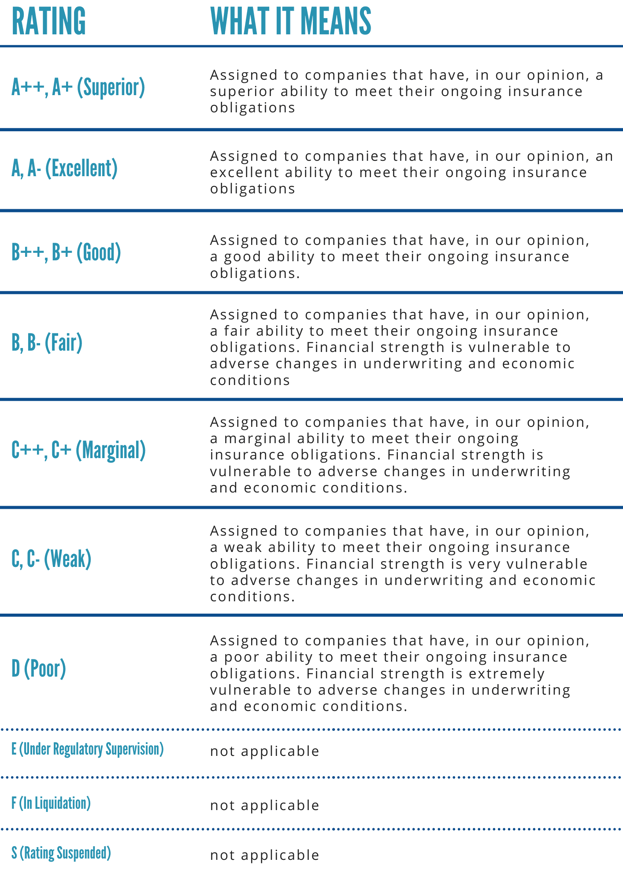

The AM Best rating system uses a scale ranging from D to A++, with D representing the lowest rating and A++ representing the highest rating for the most financially sound carrier. This rating is similar to the credit ratings provided by the Better Business Bureau, as it reflects an insurance company's ability to fulfill its financial obligations, including paying claims and debts.

What sets AM Best apart is that it goes beyond just providing a rating. The organization also offers commentary, research, and analysis to provide additional insight into the financial strength of insurance carriers. This extensive information is provided free of charge, demonstrating AM Best's commitment to supporting customers, insurance carriers, and the insurance industry as a whole.

Over the years, the AM Best rating has become one of the most trusted sources for insurance carrier information. Lawyers and insurance consumers rely on these ratings to make unbiased decisions when choosing an insurance provider to partner with. By considering the AM Best rating, attorneys can ensure that they are selecting a carrier that is financially stable and capable of meeting their coverage obligations.

How Does AM Best Determine Ratings?

Through a rigorous process, each insurance company is researched by AM Best’s advisory board and is assigned a rating in four different categories:

- Best’s Financial Strength Rating (FSR)

- Best’s Issuer Credit Rating (ICR)

- Best’s Issue Rating (IR)

- Best’s National Scale Rating (NSR)

For the purposes of this article, we are going to focus on the Best’s Financial Strength Rating (FSR). While the other ratings are worth mentioning, they do not have a significant impact on consumers.

Throughout the insurance industry, you will see insurance carriers taute their AM Best rating. When a rating is listed on the insurance company’s website or promotional materials, they are referring to their Best’s Financial Strength Rating.

Below is a breakdown of AM Best’s Financial Strength Rating (FSR). The ratings/grades here are determined based on the insurer’s ability to meet ongoing obligations and financial strength. According to AM Best’s website, the ratings are as follows:

AM Best Company. (2020). AM Best’s Consumer Insurance Information Center.

AM Best Company. (2020). AM Best’s Consumer Insurance Information Center.

Retrieved May 26, 2020, from http://consumers.ambest.com/content.aspx?rec=261606

Maximizing the Benefits of the AM Best Rating in Your Insurance Carrier Selection Process

In the insurance industry, the AM Best rating is taken very seriously. Many insurance consumers take the AM Best rating into consideration when deciding on an insurance carrier for their legal malpractice insurance policy.

The AM Best rating depicts the stability of the carrier, financial strength, and an ongoing ability to meet coverage obligations to their clients.

As a consumer, many of us do our own research to determine what to purchase. Insurance is just like any other purchase, while there are many factors to consider, third-party ratings are worth evaluating.

For example, if you were looking to buy a car, you would most likely give some consideration to the make, model, color, and other enhancements. But, ultimately, we want to know, will this car get me from point A to point B safely? If you are going to make a significant investment in a car, you want to make sure you and your loved ones are protected. To determine this, you might check out the IIH Safety Rating.

The AM Best Rating works the same way. This rating provides you, the consumer, with a trustworthy, third-party rating of how your law firm will be protected by your insurance carrier.

Much like other rating services, AM Best has made it as easy as possible for you to evaluate insurance carriers. Simply visit the AM Best website, type in the insurance carrier you’re interested in reviewing and AM Best will generate a rating based on the table shared above.

The Impact of the AM Best Rating on Your Law Firm

The AM Best rating can have a large impact on your law practice. Whether that impact is positive or negative is up to you.

Choosing an insurance carrier with an Excellent AM Best rating (A- or above) will ensure that any potential claims you may come across will be handled by a financially healthy and stable insurance provider.

If a claim were to arise, an insurance provider with a good AM Best Rating can be counted on to follow through with coverage and financial obligations within their policy.

On the flip side, if a law firm were to select a malpractice insurance carrier with a less-than-stellar AM Best rating, handling claims may prove to be a difficult process. In the table above, the lower ratings (B++ and below) are more vulnerable and less financially stable.

Insurance serves as a crucial safety net, providing financial security in times of uncertainty. As a lawyer, you invest years into an insurance program, ensuring protection in the face of worst-case scenarios. However, choosing a low-rated insurance carrier puts you at risk of shouldering the expenses of a claim, as they may not be able to afford to cover their insured's claims. Hence, it is essential to select a reputable insurance carrier that can fulfill their obligations and provide the necessary support when needed.

Furthermore, insurance carriers with low ratings are at a higher risk of shutting their doors. If this occurs, what happens to your policy? While there are safety nets in place for this exact scenario, there is a risk that despite the money you invested, your coverage could be limited.

Insurance is an investment worth researching before committing to an insurance carrier or policy. It’s essential that the insurance company you're pursuing can be trusted with handling your business and upholding their end of the deal.

Determining the Ideal AM Best Rating for Your Law Firm

When it comes to evaluating carriers based on their AM Best rating, AM Best Company takes a neutral stance and does not provide specific guidelines for which ratings are considered adequate or the best. Instead, they simply provide the ratings, leaving it up to individuals to interpret them based on their own needs and preferences.

However, based on our expertise in the insurance industry, we highly recommend selecting an insurance carrier with an A- rating or higher. Insurance carriers that maintain ratings above A-, particularly for an extended period, have proven to consistently deliver exceptional service, reliable coverage, and swift claims handling, all at a reasonable price.

Of course, the decision of whether or not to choose a carrier below an A- rating ultimately depends on your tolerance for risk. It's important to consider your specific needs, budget, and level of comfort before making a decision. However, the good news is that highly-rated insurance carriers are not hard to come by. There are many legal malpractice carriers available with an A rating and above, providing a wide range of options for you to choose from.

When selecting a legal malpractice carrier, reviewing AM Best ratings is an excellent first step. By considering the financial strength and stability of the carriers, you can ensure that you are partnering with a reputable company that can fulfill its obligations and provide the necessary support when needed. Once you have compiled a list of carriers that meet your desired rating criteria, it's important to move on to reviewing other factors that make a great insurance carrier, such as coverage options, customer service, and pricing. By considering all of these factors together, you can make an informed decision and select the insurance carrier that best meets the needs of your law firm.